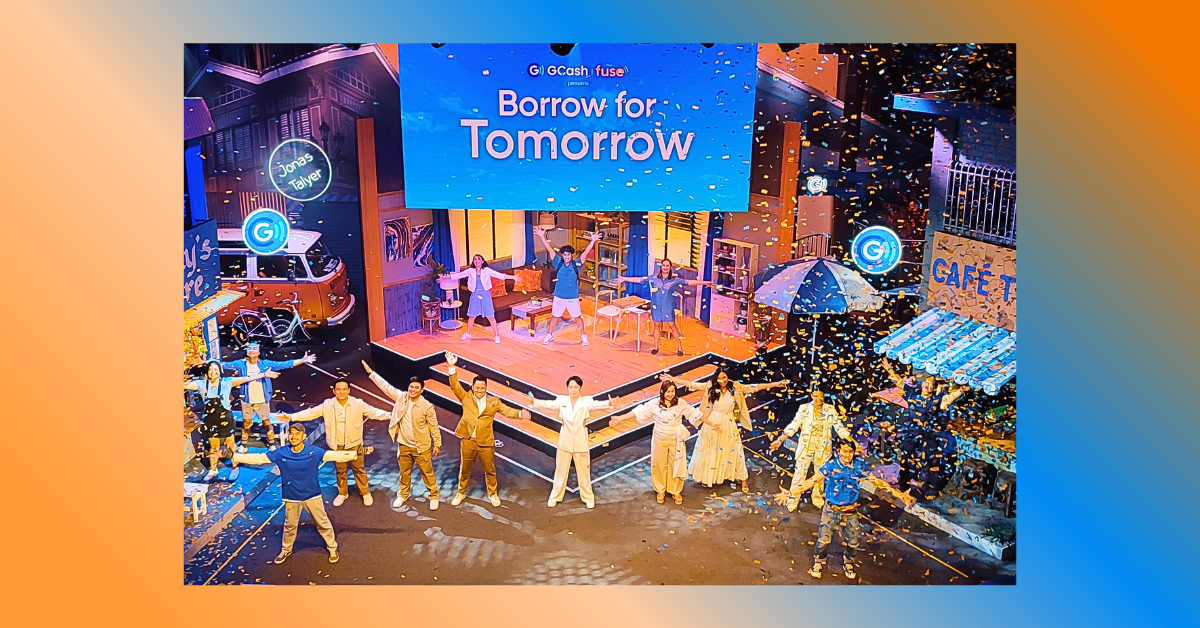

In a world where dreams know no bounds, leading finance superapp GCash is showing Filipinos that dreams can become reality with a little help. The fintech company recently unveiled its latest financial offerings in an immersive product showcase, “GCash x Fuse: Borrow for Tomorrow,” held at the Maybank Performing Arts Theater last 30 August 2023.

With a mission to foster financial progress for all, GCash, in collaboration with its lending arm Fuse Lending Inc., reintroduced its well-received lending products: GLoan, GGives, and GCredit, and unveiled their newest addition: the GCash Sakto Loans — a nano-loan tailored for GCash users to conveniently borrow small amounts for their everyday needs.

“With everyday Filipino stories at the core of our interactive product showcase, we draw inspiration from two concepts that are uniquely pinoy. While the idea of ’tingi’ is often seen as taking small portions needed for the moment, we recognize that even these smallest ways of support can help fuel the biggest of dreams. All these, coupled with our innate characteristic of bayanihan, help us champion collective strength in reaching dreams. It is through these distinct similarities that we are able to come together as a nation and weave stories of progress,” according to Tony Isidro, CEO of Fuse.

Organized by Yaparrazi Events and penned by Cathy Azanza-Dy, the “Borrow for Tomorrow” event showcased relatable stories of ordinary Filipinos living in Barangay Pag-Asa. The stage design drew inspiration from the lively and vibrant elements of a typical Filipino neighborhood, where both big and small dreams come to life.

Inside one humble and cozy home, a supportive mother named Mila pondered how she could replace her son’s charger-dependent laptop without depleting her savings. For significant purchases, GCash offers GGives, a flexible installment plan that permits eligible users to buy high-value items worth up to PHP125,000 and pay for them over 24 months, requiring zero downpayment and minimal documentation. This allows diligent parents like Mila to enhance their lives without straining their budget.

Meanwhile, outside her home, Rowena, the family’s breadwinner and side hustler, eagerly awaited her salary and commission, searching for a financial lifeline to cover utility bills and groceries. GCredit, in partnership with CIMB, provides an ever-ready credit line of up to PHP50,000, serving as a financial cushion during tight times, not just during “petsa de peligro” but for any unexpected emergencies. With its straightforward application process, low monthly interest rates as low as 5%, and manageable repayment terms, hardworking individuals like Rowena can effortlessly manage their everyday expenses.

Teresa, the owner of a neighborhood carinderia, and Isko, a delivery rider, dreamed of accumulating enough capital to elevate Aling Teresa’s Cafe. For aspiring entrepreneurs and small business proprietors, GLoan offers immediate cash access of up to PHP125,000, deposited directly into eligible users’ GCash wallets, serving as an investment for launching or expanding their business ventures, whether through equipment upgrades or skills enhancement.

At the local sari-sari store, Lito needed to borrow two kilos of malagkit rice, hoping his friend Inday would once again come to his aid. Like Lito, many Filipinos find themselves searching for “pambale” when finances get tight but feel a sense of shame due to the fear of judgment. Not everyone has the luxury of having friends, family, or colleagues who can lend a helping hand. Enter GCash Sakto Loans, offering users a hassle-free option to borrow small amounts to manage cash needs for any GCash transaction, be it online or offline.

Breaking the Taboo: Sakto Loans for All

The reality is that nine out of ten (9/10) Filipinos have had to borrow money at some point, but the stigma around loans remains pervasive, leading many to feel embarrassed about their financial struggles. Fuse recognizes that borrowing is an integral part of life, and more Filipinos need access to equitable, uncomplicated, and inclusive lending options. Since 2016, Fuse has empowered over 3 million Filipinos to chase their dreams by disbursing over PHP100B in loans.

The introduction of GCash Sakto Loans to its comprehensive range of lending products, tailored to various needs, is a significant step forward. GCash and Fuse aspire to reduce the stigma associated with borrowing, ensuring that users no longer have to feel ashamed about seeking “pambale.”

“We believe that Filipinos deserve better access to fair loans to help them realize their dreams faster. At Fuse, we want to make borrowing money less complicated so they could spend their resources fulfilling their goals, big or small. We do this by providing them with lending products with zero hassle from application to disbursement and payment, zero additional documents, zero waiting time for eligible customers and zero interest for select popular offline and online stores,” Isidro added.

GLoan Sakto and GGives Sakto allow users to borrow as little as PHP100 up to PHP1,000 with a minimal 15% processing fee and no interest, with repayment options on the 15th or month-end. Sakto Loans serve as an accessible entry-level loan option for those not yet eligible for GLoan and GGives.

Just as the characters in the immersive showcase rallied to help one another meet their daily needs and reach their loftier aspirations, “Borrow for Tomorrow” exemplified the unyielding spirit of Filipino bayanihan. GCash and Fuse aim to stand by individuals like Mila, Rowena, Teresa, Isko, and Lito, offering them the support they need to elevate their lives, manage everyday expenses, and achieve their dreams.

Users can access GGives, GLoan, and GCredit through the GCash dashboard under the “Borrow” section of the app.